While writing about RPD, RPI and PS I missed out on a very important feature. Your portfolio health (PH), yet another term in microstock. I’ve heard other people talking about hitting the wall, from which moment you can keep adding and adding assets to your portfolio without earning more. Others had a horrible surprise of a sudden and enormous drop in income. Luckily, both of those situations can be prevented by keeping track of one stat: your portfolio health!

What is Portfolio Health and how to calculate it?

What exactly is your microstock portfolio health? The best, but rather complicated method to get your portfolio health is to take the average amount the top 10% of your best-selling assets have been sold minus the average amount all assets are being sold and divide that by the average amount all assets are being sold * 100. Okay, that was quite complicated so I put it in a formula which you can see below!

The closer your PH is to 0, the healthier your portfolio as your earnings are less dependent on your top 10% earners! The higher the PH how more dependent your earnings are on your top 10% of your portfolio and the more prone your portfolio is to sudden changes! This is not yet integrated in the PangaMedia Analytics app but will be in a future update!

Unique Assets - yet another method

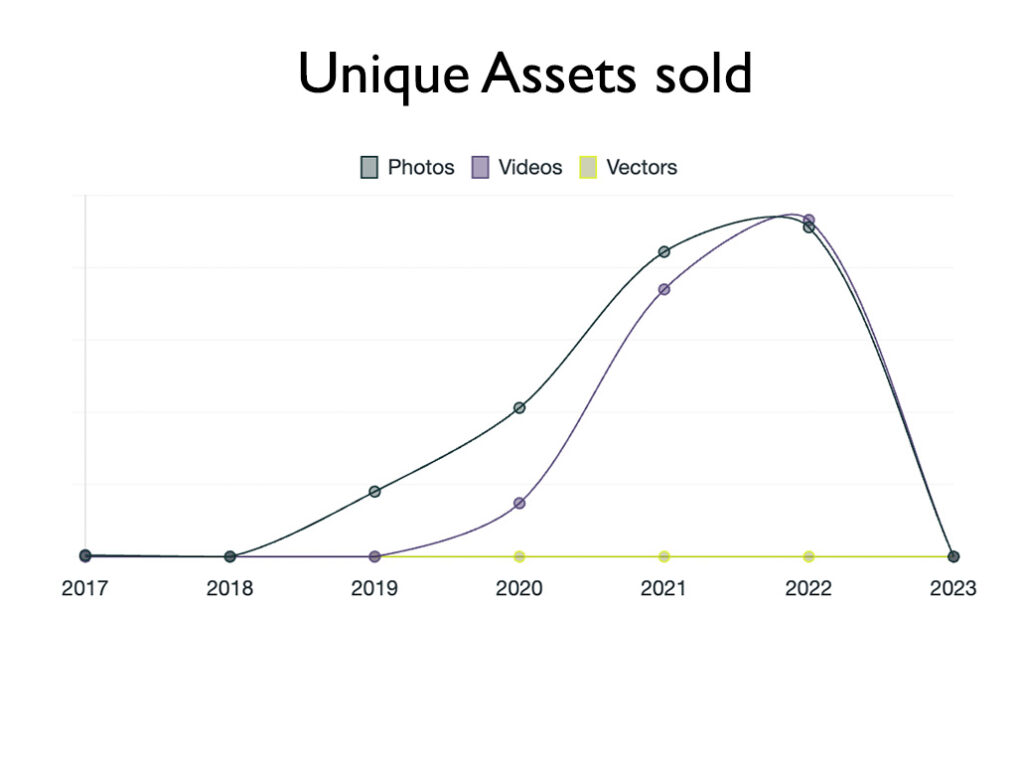

A easier method that is less complicated is to look at the unique assets being sold. If the amount of unique assets that you sell over a certain time span is stagnating, you might be hitting the so called wall and you should find ways to improve this amount once more (or try to improve the RPI). If the amount of unique assets being sold is getting lower and lower you are most likely getting less earnings. Moreover, once it get’s very low you might experience the ‘sudden’ and ‘enormous’ drop in income to almost zero when your last good earner falls away.

This method however, does not take into account how much of those unique sold assets are being sold more than once. That is why you should also calculate your PH, if your portfolio result in a very high number your earnings are rather dependent on a small amount of your portfolio which could cause the ‘unexpected’ drop if those earners fall away (which could happen!) while you still sell a large amount of different assets.

Leave a Reply